CFRA REITERATES STRONG BUY RECOMMENDATION ON SHARES OF TESLA INC.

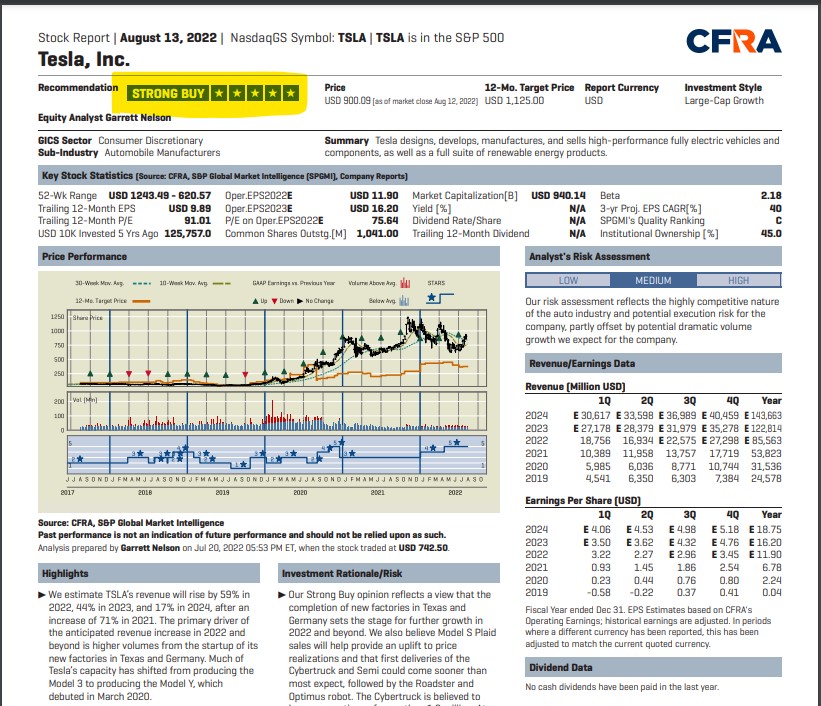

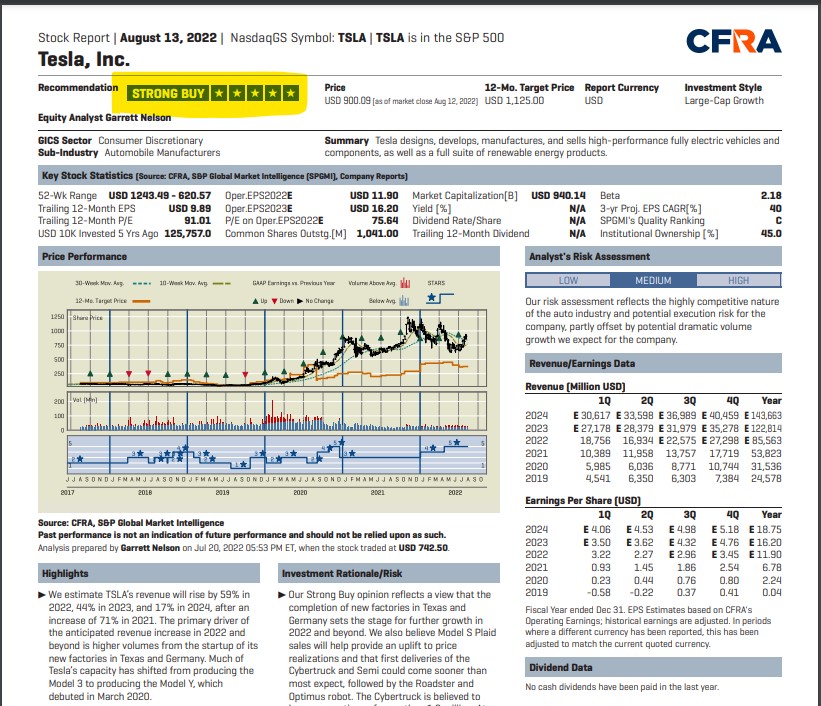

We lift our 12-month price target to $1,245 from $1,125, based on a '24 P/E of 60x. We raise our adjusted EPS estimates to $12.45 from $11.90 for '22, to $17.25 from $16.20 for '23, and to $20.75 from $18.75 for '24. The signing of the Inflation Reduction Act was the equivalent of "Christmas in August" for Elon Musk & Co., as we peg TSLA as the biggest winner from the new law, as most versions of the industry's two bestselling EVs (Tesla's Model Y and Model 3) become eligible for the $7,500 federal EV tax credit effective January 1, 2023. Previously, all Tesla vehicles had phased out of tax credit eligibility after hitting the 200K units per manufacturer cap. Moreover, the new law significantly alleviates concerns about EV competition, as roughly 70% of the 72 EV models currently for sale in the U.S. suddenly became ineligible for the tax credit under the new law. We reiterate our top pick status on TSLA and will update our estimates and target following the 3-for-1 stock split set to take effect on August 25.